In a market where mortgage and lending leads can easily exceed $50–$200 per lead, generating high-quality HELOC (Home Equity Line of Credit) and VA loan leads for under $15 each almost sounds unbelievable. But with a combination of high-intent Google Ads, a carefully engineered 18–22-step qualification form, and smart data funneling, we did exactly that.

This blog post breaks down the full process, including the targeting, ad strategy, funnel architecture, and optimization techniques that made it possible. If you're in real estate, mortgage brokering, lead generation, or digital advertising, you’ll want to take notes.

Table of Contents

- Why HELOC and VA Loan Leads Are High-Value

- Market Demand & Consumer Behavior

- Lifetime Value of a Loan Client

- Why Google Search Traffic Is Ideal

- Step 1: Generating High-Intent Traffic with Google Ads

- Keyword Strategy for HELOC & VA Loans

- Ad Copy That Converts Clicks

- Extensions and Quality Score Optimization

- CPC and Click-Through Rate Results

- Step 2: The 18–22 Step High-Intent Qualification Funnel

- Why Long Forms Work Better for Financial Leads

- Full Breakdown of the Form Stages

- Psychological Triggers: Commitment & Progress

- Drop-Off vs Completion Insights

- Step 3: Landing Page Optimization for Conversions

- Headline & Subheadline Framework

- Form Design and Progress Bar

- Trust Signals and Compliance Elements

- Mobile Experience Strategies

- Step 4: Cost Per Lead (CPL) Performance Breakdown

- Traffic-to-Lead Funnel Metrics

- Full Cost Calculation (CPC to CPL)

- Lead Quality & Lender Feedback

- Step 5: Automation, CRM Integration & Lead Delivery

- Zapier/API Workflow Setup

- Instant SMS & Email Follow-Up

- Lead Routing by Product & State

- Form Abandonment Retargeting

- Step 6: Why This Strategy Works So Effectively

- Filters Low-Intent Leads Efficiently

- Delivers Ready-to-Discuss Applicants

- Scalable & Repeatable Across States/Loan Types

- Step 7: Blueprint to Replicate This System Yourself

- Step-by-Step Implementation Checklist

- Tools & Platforms to Use

- Compliance and Data Security Tips

- Conclusion

Why HELOC & VA Loans Are the Perfect Opportunities for Lead Generation

Before diving into lead generation tactics, let’s look at why HELOCs and VA loans are lucrative niches:

1. High Demand in an Uncertain Market

With interest rates fluctuating, many homeowners are turning to HELOCs to access cash for renovations, debt consolidation, or financial flexibility, without having to sell their property. At the same time, VA loans remain one of the most affordable mortgage options for active-duty military and veterans, offering zero-down payment and low-interest refinancing.

2. High Value per Customer

Lenders are often willing to pay $100–$300 per qualified lead because a single funded loan can generate thousands in commissions or long-term customer value.

3. Google Search Intent = Warm Leads

Unlike Facebook or cold outreach, where users aren’t actively looking for loans, Google users are searching phrases like:

- “Best HELOC rates 2025”

- “How to qualify for a VA home loan”

- “Home equity line of credit eligibility”

- “VA refinance cash-out requirements”

This means they already have buying intent. That's why Google Ads is a goldmine, if used properly.

Step 1: Attracting the Right Clicks with Google Ads

Keyword Strategy

We focused on high-intent, bottom-of-funnel keywords such as:

- “Get a HELOC quote”

- “Apply for VA refinance loan”

- “Home equity line of credit pre-approval”

- “Best VA lenders near me”

These weren’t random keywords. We avoided high-volume but low-intent terms like “what is a HELOC” or “VA loan benefits,” because those searchers are in research mode, not ready to apply.

Google Ads Copy That Converts

Instead of generic messages like “Get a Loan Today,” our ads leaned into trust, speed, and personalization:

- “Check HELOC Eligibility – No Credit Impact”

- “VA Loan Pre-Approval in Minutes – No Fees”

- “Unlock Home Equity | See If You Qualify Today”

- “Military Homeowners: Access Cash with VA Refinance”

Each ad also included:

✔ Call extensions

✔ Structured snippets (“No application fees, Fixed rates available”)

✔ Location and site link extensions

These elements improved ad visibility and click-through rate (CTR), lowering costs over time.

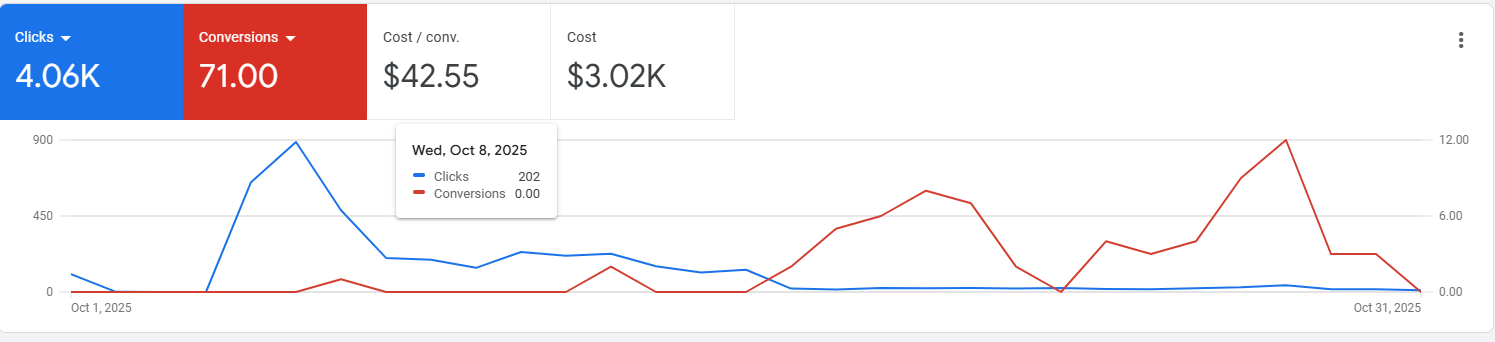

Cost Per Click (CPC) Results

Due to refined keyword selection and strong ad relevance:

- Average CPC: $1.50 – $2.40

- Click-through rate (CTR): 5–8%

- Quality Scores: Increased to 8–10 (leading to lower ad spend)

Above the Fold Essentials

Make sure your landing page includes these elements without scrolling:

- Sticky call button or phone number that follows users as they scroll.

- Visible contact form for users who prefer not to call.

- Trust elements like Google reviews, logos, or certifications.

- Relevant photo or video of your team performing the actual service.

“You always want to have that option available to where they're able to call you, and they don't have to scroll up.”

Step 2: The High-Qualification 18–22-Step Form

Most marketers use simple 3–5 question forms, collecting name, email, phone, and loan type. But that approach floods your CRM with unqualified, low-intent leads.

Instead, our secret weapon was a multistep application funnel with 18–22 questions, similar to a real lender pre-screening process.

Why Make It Long on Purpose?

It may sound counterintuitive, but here's why it works:

- Low-intent users drop off early, saving you time and money.

- High-intent, serious applicants continue, increasing overall conversion quality.

- Psychological investment: After answering multiple questions, people are more likely to complete the form rather than quit at the end.

Form Flow Preview

Step 1–3: Property Basics

✔ Do you own or rent?

✔ Estimated home value?

✔ Remaining mortgage balance?

Step 4–6: Loan Intent

✔ Type of loan: HELOC, VA purchase, VA refinance

✔ Purpose of loan: Debt consolidation, home improvement, cash-out refinance

✔ Timeline: “ASAP,” “Next 30 days,” “3–6 months,” etc.

Step 7–10: VA Loan Qualification (If Applicable)

✔ Branch of military service (Army, Navy, Coast Guard, etc.)

✔ Service status (Active duty, Veteran, Retired)

✔ VA Certificate of Eligibility (COE) status

✔ Discharge type (Honorable, General, Other)

Step 11–14: Financial Profile

✔ Estimated credit score (range-based)

✔ Current income level and employment status

✔ Bankruptcy or foreclosure history

✔ Existing debts (student loans, credit card balances)

Step 15–18: Contact Details (Only at the End)

✔ Full name

✔ Email address

✔ Phone number

✔ Best time to be contacted

By collecting personal contact info at the end, we prevented early friction. Users who made it this far were engaged and ready to submit.

Step 3: Landing Page & Conversion Optimization

The landing page was intentionally minimalist. No navigation bars, no distractions, just a headline, value proposition, trust elements, and a form.

Landing Page Strategy

✔ Headline Example:

“Check Your HELOC Eligibility, No Credit Check, No Obligation”

✔ Subheadline:

“Find out how much equity you can access in less than 3 minutes.”

✔ Trust Builders:

- BBB Accredited badges

- Secure SSL icons

- “No SSN required to start” disclaimers

- Reviews/testimonials from real users (with compliance approval)

✔ Progress Bar (Huge Conversion Booster):

Every step displayed a visual tracker like “Step 7 of 20 – 68% Complete”, reducing form abandonment by giving users a sense of progress.

✔ Mobile Optimization:

Over 65% of our traffic came from mobile. We used thumb-friendly spacing, large buttons, and single-question-per-screen design for speed.

Step 4: Cost Per Lead Breakdown

Here’s a transparent breakdown of how the numbers worked out:

| Metrics | Result |

|---|---|

| Average CPC from Google Ads | $1.50 – $2.40 |

| Landing Page to Form Start (CTR) | 18–24% |

| Form Completion Rate | 22–35% |

| Final Cost Per Qualified Lead | $9 – $14.80 |

Final ROI Snapshot

- Cost per lead: under $15

- High intent: Over 70% of leads had 680+ credit scores

- Many had home equity $80K–$200K

- Lender partners reported 15–22% funded loan conversion

Step 5: Automations & Scaling

Once leads were collected, the next challenge was speed. Mortgage leads go cold within minutes if no one follows up.

Automation Setup

✔ Zapier/API integration sent leads directly to CRM.

✔ Instant SMS & Email Confirmation to applicants:

“Thanks for applying! A loan specialist will reach out within 10 minutes.”

✔ Lead Routing , VA and HELOC leads were sent to different lender partners based on state licensing.

Retargeting Strategy

Not everyone completes the form on the first try. That’s where retargeting comes in:

- We used Google Display + YouTube remarketing for users who reached 20–50% of the form but didn’t finish.

- Retargeting ads said: “Almost Done, Finish Your Qualification” with a direct link back to the step they left.

This alone increased completion rates by 12–18%.

Step 6: Why This Strategy Works So Well

1. Filters Out Tire-Kickers

Short forms might bring cheaper leads, but most won’t convert. Our longer funnel filters out low-quality users before they ever hit your CRM.

2. High-Intent = Higher Conversion to Loans

We didn’t just generate names and emails. We delivered:

- Equity amount

- Credit score range

- Service status (for VA loans)

- Income and mortgage balance

This allowed lenders to skip unnecessary calls and move straight into underwriting.

3. Scalable & Repeatable

Once the funnel was built and approved for compliance, we duplicated it for new states, demographics, and loan products.

Step 7: Want to Do This Yourself? Here’s a Quick Blueprint

| Step | Description |

|---|---|

| 1 | Research high-intent Google keywords for HELOC/VA loans |

| 2 | Create ads that promise qualification, not generic quotes |

| 3 | Build a multistep form with 18–22 questions |

| 4 | Ask personal info at the end, not at the start |

| 5 | 5 Optimize landing pages for mobile + load speed |

| 6 | Connect via Zapier/API to CRM and auto-responses |

| 7 | Add retargeting ads for drop-offs |

| 8 | Track everything, CPC, CPL, LTV, ROAS |

Final Thoughts

Generating mortgage loan leads for under $15 is possible, not with shortcuts, but with smarter systems. Google Ads delivers the intent. The multistep form filters the serious from the curious. Automation keeps response time under 5 minutes. And when done right, lenders are more than happy to pay for consistency and quality.